You’ve booked your flights. The itinerary is almost ready. But before you zip that suitcase shut, let’s talk about something many travellers leave for the last minute—converting your funds for overseas travel.

We’ve seen it happen far too often. You’re all set for that dream holiday or work trip abroad, but when it comes to money conversion, confusion kicks in. Should you carry cash or a card? Where should you convert your money? When is the right time to buy forex? The truth is, a few simple decisions can make a big difference to how smoothly your trip goes.

At Unipay, we believe managing your travel money shouldn’t feel like a puzzle. So here’s a clear, no-fluff guide to what you should and shouldn’t do when dealing with forex services for overseas travel.

Why Getting Forex Right Matters For Converting Your Funds

You wouldn’t leave your passport to the last minute, right? Then why do it with your travel currency?

Converting your funds in a rush can cost you more, leave you underprepared, or worse—land you in a foreign country with limited ways to access your money. Whether you’re a frequent flyer or a first-time explorer, understanding the dos and don’ts of foreign exchange can save you both stress and money.

DO: Plan Your Forex in Advance before Converting Your Funds

You know that feeling when you exchange money at the airport and immediately regret it? That’s because airport counters often offer poor currency exchange rates.

Instead, plan early. Monitor exchange rates once your travel dates are final and buy forex when the rate is favourable. At Unipay, we help you stay ahead by offering real-time rate alerts and competitive pricing—so you never have to second-guess your timing.

DON’T: Wait Until the Last Minute

There’s a reason every guidebook says this—panic buying is never a good idea. If you leave forex for the airport, you’re giving up control and getting the worst deal.

Even if you’re taking a forex card, it’s wise to load it a few days in advance. This gives you time to check balances, understand charges, and avoid rushed decisions.

DO: Use Forex Cards for Converting Your Funds

Cash is handy, but you don’t need to carry it all. Forex cards are widely accepted across hotels, restaurants, shopping centres, and online bookings abroad. They’re safer than cash, easy to block if lost, and come with better rates than credit cards or international debit cards.

At Unipay, our multi-currency forex cards make spending abroad smooth and secure. You can load up to 16 currencies, track your expenses, and top-up as needed—without hidden charges.

DON’T: Swipe Your Regular Credit or Debit Card

It may seem convenient, but international usage of your Indian bank card often comes with high transaction fees and poor conversion rates. Not to mention, dynamic currency conversion (DCC) at foreign merchants can catch you off guard and inflate your costs.

Stick to forex services designed for travel. You’ll have more control, better rates, and peace of mind knowing your account back home is untouched.

DO: Keep Some Cash—But Not Too Much

Carrying a small amount of foreign currency in cash is essential. Taxis, tips, street food, or emergency buys often don’t take cards. But don’t go overboard. Carrying too much cash can be risky.

We recommend carrying around 30% of your travel budget in cash and keeping the rest on a forex card. This strikes a good balance between convenience and safety.

DON’T: Exchange Money Abroad Without Comparing Options

While it’s easy to step into any currency exchange counter abroad, the rates and service fees can be steep—especially in tourist hotspots. Worse, some counters may round off or charge extra commissions.

Before you sell forex overseas or start converting your fund, compare rates online or reach out to your local partner like Unipay. We often help customers sell forex at competitive rates and avoid foreign exchange losses.

DO: Understand Country-Specific Rules

Different countries have different attitudes towards cash and card payments. For example:

- In Japan, cash is still king at many small establishments.

- In the USA, cards are widely accepted, but tipping in cash is common.

- In parts of Europe, contactless payments are preferred.

Knowing this in advance helps you decide how much to load on your forex card versus how much cash to carry. And yes, our team at Unipay can help guide you based on your destination.

DON’T: Forget to Keep Forex Receipts

This one’s easy to overlook. But holding on to your forex transaction receipts can help you in many ways. If you plan to sell forex once you return, these documents will be necessary. They also serve as proof of funds in case of travel queries at immigration or during stays.

Keep a digital copy handy on your phone and the originals in your travel folder.

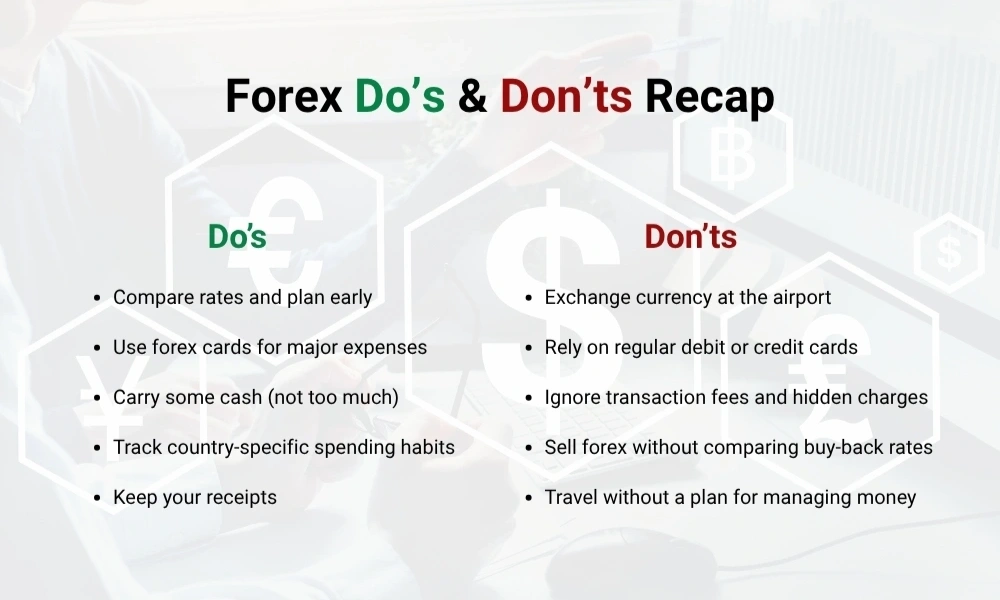

Forex Do’s and Don’ts before Converting Your Funds

Let’s recap the golden rules for a stress-free forex experience:

Final Thoughts: Make Forex Work For You

Travelling should be exciting, not stressful. And with the right forex services, it can be. At Unipay, we’ve helped thousands of travellers buy forex, load forex cards, and sell forex with zero hassle. Our experts don’t just give you the currency—you get honest advice, transparent pricing, and support that travels with you.

So before your next trip abroad, remember: don’t just plan your itinerary, plan your currency too.

Want expert help for foreign exchange? Connect with us today and travel smart.